The Scheme stands commenced from 1 st October 2020 and shall remain open for registration of eligible. Online payment of PF money to your nominees.

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

A late payment interest rate of 6 per year is imposed for each day such contribution is not paid on time.

. Online claim filing in case of death of the EPF member. For every single day that there is a delay in EPF payment. Donation of up to Rs2000 made by any payment mode except cash.

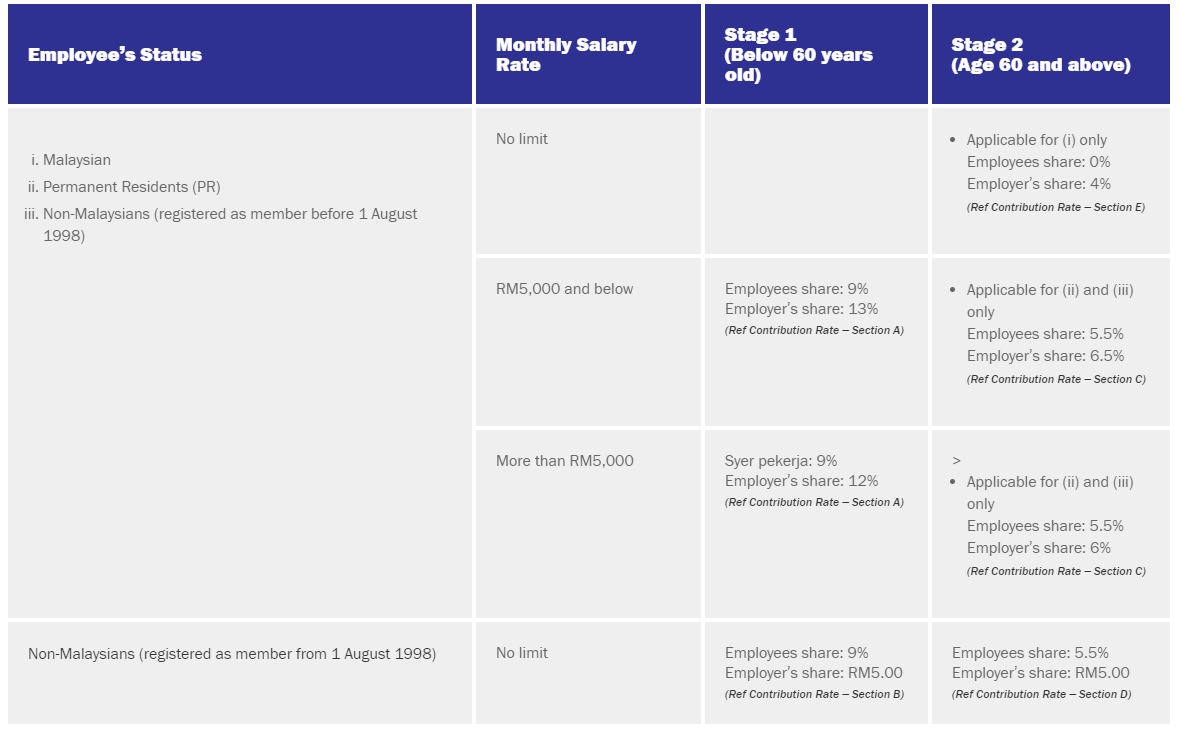

Due date for payment of Provident Fund contributions is 15 days from the end of month in which wages are paid plus grace period of 5 days. In addition to 12 of employer PFPS contribution the employer also has to pay other charges. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

Loan defaults are bad news for people who have stood as guarantors to loans taken by friends and relatives. EPF Interest for Late Payment under Section 7Q. There are a few channels SOCSO have disclosed on where employers may auto deduct from.

Employer 367 into EPF. This deduction can be claimed for premiums paid towards insuring self spouse dependent children and any member of Hindu Undivided Family. Employee 12 of Employee Provident Fund EPF.

Latest news related EPF withdrawal. For an employer to make the EPF online payment they must be registered under the PF Act. The breakup of EPF contribution is different for the employee and the employer.

EPF e-nomination would result in speedy payment of PF pension and insurance of up to Rs 7 lakh to eligible nominees in case something were to happen to you. Thus if wages pertaining to April 2012 is paid on say 7th May 2012 due date for payment of Provident Fund contribution is 20th June 2012 ie. Contribution to political parties by companies.

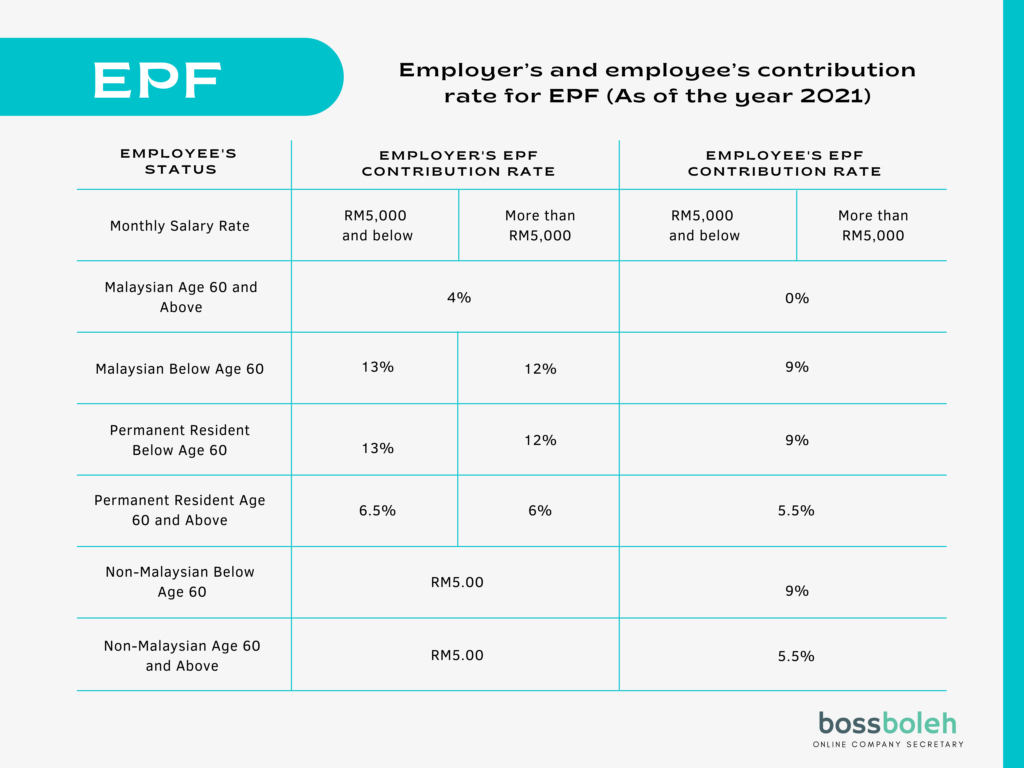

The full break-up of the percentage of contribution is as seen below. Purchase of breastfeeding equipment for own use for a child aged 2 years and. EPF Late Payment Penalties.

Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month. 050 into PF admin. Contribution payable under the EPF MP Act 1952 or only the employees share depending on the employment strength of the establishment directly to the Universal Account Number of eligible employee maintained by the EPFO.

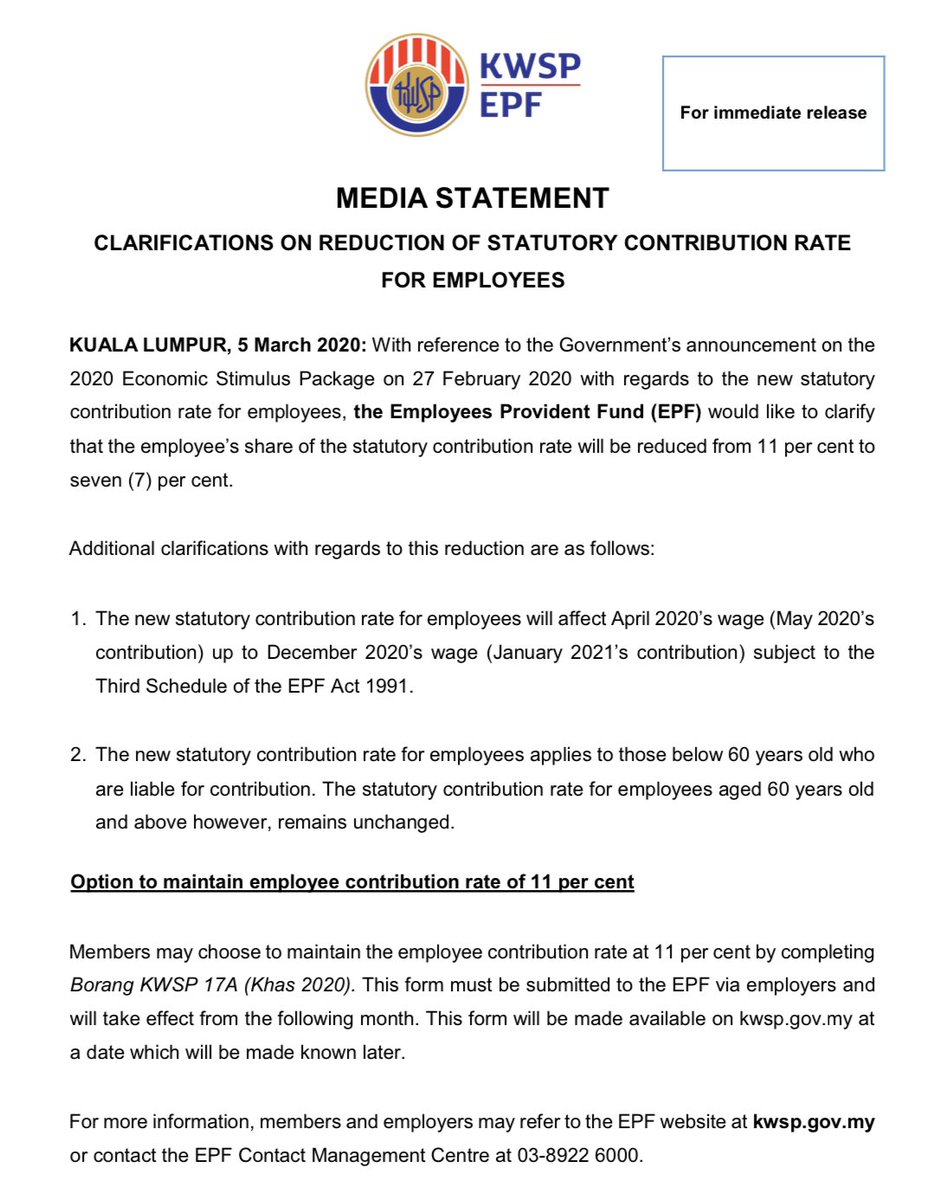

EPF Contributions To Be Deducted at 24 from August 1 2020. This deduction is an addition to the deduction granted under item 10. Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020.

We can sum-up the benefits of EPFO e-nomination in the following board points. The contribution split equally at the rate of 10 between the employer and. Premiums paid toward all life insurance policies are eligible for tax benefits under Section 80C.

Contribution to political parties by individuals. Access to internet banking makes EPF contribution payments much easier now. Check our guide to conduct PF balance check.

There are other risks that the guarantor is exposed to. Deductions on income by way of royalty of a patent. The Employee Provident Fund Organisation EPFO has provided a social security scheme called the Employee Pension Scheme EPS.

This scheme makes employees working in the organised sector to be eligible for a pension after their retirement at the age of 58 years. Most people know that a guarantor is liable to pay if the borrower defaults on the loan repayment. The income received or Rs3 lakh.

15th June 2012 as increased by grace period of 5 days. In this guide we discuss how employers can make PF online payments. An employer can make the online PF payment either himself or through authorised banks.

When an employer fails to deposit the EPF contribution before its deadline then he is liable to pay an EPF interest of 12 pa. Most people know that a guarantor is liable to pay if the borrower defaults on the loan repayment. The following investments and payments are eligible for deduction under Section 80C of the Income Tax Act 1961.

Lifestyle Purchase of personal computer smartphone or tablet for self spouse or child and not for business use. Upon late payment of EPF challan two arrears ensue on the employer as follows. Payment of monthly bill for internet subscription Under own name 2500 Restricted 11.

Myfreelys Academy Kwsp Definition Of Wages For Epf Purpose All Remuneration In Money Due To An Employee Under His Contract Of Service Or Apprenticeship Whether It Was Agreed To Be Paid

Epf Member Passbook For Tax Calculation Passbook Flow Chart Hobbies To Try

Epf Contribution Reduced From 12 To 10 For Three Months

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

How To Calculate Provident Fund Online Calculator Government Employment

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

The Epfo Employee Provident Fund Organization Announced Diverse Modes To Check Pf Balance With Epf Passbook And With Epf Mobile Ap Aadhar Card Balance Passbook

How Epf Employees Provident Fund Interest Is Calculated

Why Did The Government Implement A Cut In The Epf Contribution To 10 Quora

Who Is Not Eligible For Epf Quora

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Contribution On Epf Socso Eis In Malaysia As An Employer Bossboleh Com

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint

Pf Relief May Be Taxing In The Long Term Mint

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate